The obvious question that surfaced on this topic is how the position of Gold can functionally be an alternative for the present society to save their money. As we know that nowadays there is a wide range of disparity between poor society and rich society across the country regardless of developed or developing countries. Rich society will tend to become richer because they have more fiat money which means they have more savings that will generate growth through their investment activities. Poor society will be left behind due to less of savings which mean they have less fiat money, thus will generate slight growth. The existence of downturn in economic growth will lead to a fall in the value of the currency (fiat money) and furthermore there is a difference in the value of currency of yesterday and today with the presence of increase in inflation rate. Moreover, most of the society in Malaysia chooses to earn an additional income from investing or diversifying their fiat money in many types of well known financial instrument such as in Bonds, Fixed Deposit and ASB (Amanah Saham Berhad) in order for them to acquire a return on investment according to a specific duration (long term or short term) and amount. However, most of them didn’t even realize the fall in the value of fiat money and the increase in inflation rate and this is because they always experience a shortage of fiat money or their savings even though they believe that the rate of return on investment is considered high.

Financial instrument such as bonds, fixed deposit and ASB shares more or less similar characteristic and risk regardless of less risk or high risk. Bonds are mostly known that it is backed with the trust of the government, in case the governments dissolve, the money is still safe. However, it is known that bonds offer a worst return or generally very low interest (EconomyWatch), even though some says that if “you pay more, you save more”, at the end of the day, your return is still low due to its fixed rate and inconsistency and the fall in value of the currency, same goes to fixed deposit and ASB as the return will be eroded by inflation and you might obtain a negative return after taking into account tax and inflation. The problem from this is that if your returns do not match or surpass inflation and after tax, your money is losing value.

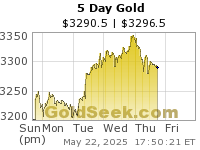

In addition, Gold can be considered as a saving alternative and also it gives advantage to the poor society to actually have an additional income because unlike other financial instruments, gold does not have a minimum deposit requirement, instead you just buy at a price based on its value in which the price of gold increase over time and has a constant fluctuation. Regardless of crisis such as political and economic uncertainty or recession, it definitely raises panic among the investors who try to find ways on different strategies to save their money or capital and it always comes back to gold which is because of its reliability, stable and liquid instrument of capital and its future saving compared to other financial instrument and also it is well known with its value in itself.

Gold is a perfect hedge for inflation which means buying power of money will falls due to inflation but the gold price rises and even surpassing inflation. We knew that the steps that the governments take to fight the downturn will lead to inflation and it will somehow cause the value of money to drop. A weakened currency is gold’s best friends (Tim Middleton, 2009). It is a common knowledge that gold is a reliable financial instrument in terms of saving and increase of income. Furthermore, China has been encouraging their citizen to consume gold for savings and also for the future consumption. Most of the society in these present days suffers from inflation which means the increase in the price of goods and that is why their fiat money will not be enough even they choose to plant it in a high rate of return financial instruments.

Hamizah Azmi

*Part 1*

*Stance*

First, stand perpendicular to your target with your feet straddling the

shooting line and shoulder width apart. Balance your body weight ...