What is Subprime Crisis?

It's an ongoing financial crisis triggered by a dramatic rise in mortgage delinquencies and foreclosures in the U.S, with major adverse consequences for banks and financial markets around the globe, e.g Europe, Asia and Latin America. Began with the bursting of the US housing bubble and high default rates on 'Subprime' and adjustable rate mortgages (ARM), beginning in approximately 2005-2006. Subprime Crisis affected the financial sector in Feb 2007, when HSBC, world largest(2008) bank, wrote down its holdings of subprime related MBS by $10.5 billion, the first major subprime related loss reported. In 2007, atleast 100 mortgage companies either shutdown, suspended operation or were sold.

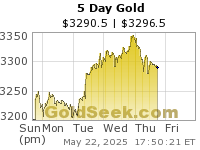

Subprime crisis caused panic in financial markets and encouraged investor to take their money out of risky mortgage bonds and shaky equities and put it into commodities as "store of value". Financial speculation on commodity futures following the collapse of the financial derivatives markets has contributed to the world food price crisis and oil price increases due to a 'commodities super-cycle'. Financial speculators seeking quick returns have removed trillions of dollars from equities and mortgage bonds, some of which has been invested into food and raw materials. Lehman Brothers declared bankruptcy on 15 September 2008, after the secretary of the Treasury Henry Paulson, citing moral hazard, refused to bail it out.

How Subprime Crisis Lead to Global Economic Crisis?

Tired of writing, I show to you in sequence....

- 1. High oil prices -> high food prices & global inflation.

- 2. Subprime Crisis -> substantial credit + liquidity crisis leading to the bankruptcy of large and well established investment banks as well as commercial banks in various nations around the world

- 3. Increased unemployment -> global recession 2008/2009.

Causes of Subprime Crisis

I will state the causes for now and continue explaining it later:

- # Housing market bubbles

- # Investment Speculation

- # High-risk mortgage loans and lending practices

- # Securitizations practices

- # Slow central banks responses

- # Financial institution debt levels incentives

- # Credit default swaps

I will continue with subprime lending and the effect of money injection. This article is to make things clear why you should save in something that more sound then the fiat. :)